Emphasis is placed on breakouts rather than breakdowns because today is the first day where I’ve seen more breakouts than breakdowns in a very long time. We are at a weird stage in the market right now. Many stocks have broken out to the upside, but most stocks are still within consolidation. Given that we have hundreds and hundreds of earnings reports this week, the market will continue to be volatile. Even today, the market zigzagged, forming an ascending triangle, which later broke out. Again, I am seeing considerable strength in the materials and industrials sectors and they are leading whatever rally we do get.

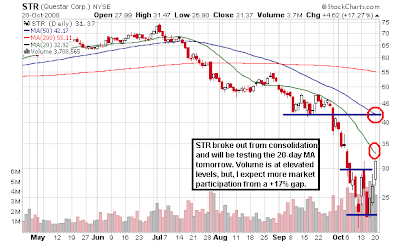

Most break outs, including the ones listed below are at a point where they are going to test 1) the 20-day MA, 2) September’s low, and then 3) the 50-day MA. The 20-day MA is not some magical indicator, but it’s what most stocks primarily follow during uptrends and is a secondary indicator for downtrends. These three present key resistance levels that need to be broken for stocks to climb out of their hole. It won’t be easy, but here are several names to focus on:

Costco: Sell The New Year Rally

25 minutes ago

5 comments:

Looking at the breakouts listed today I'm curious about what you see in one (MPEL). You show how it cleanly broke through the 20 MA and headed to the 50 MA. When I look at it, like you suggested, it follows the 20 MA very closely and the last time it got close to the 50 MA (Aug 17th) it dropped significantly again. Therefore, I look at this as a short and I'm curious to see if my reading of the chart is off. Can you share some thoughts for me if you have a chance. Thanks

MELI did hit the 50-day MA and failed it, however, it's not a major failure. I don't really like the chart pattern for a short, and it looks to be consolidating. I wouldn't short it personally.

I'm not planning on shorting it, I'm just curious to see if I'm reading the chart properly. I stayed away from going long b/c it hasn't gotten throught the 50-day MA. Do you agree?

it may be able to take it on. Today's move was a healthy beginning toward consolidation.

ok thanks

Post a Comment