Emphasis is placed on breakouts rather than breakdowns because today is the first day where I’ve seen more breakouts than breakdowns in a very long time. We are at a weird stage in the market right now. Many stocks have broken out to the upside, but most stocks are still within consolidation. Given that we have hundreds and hundreds of earnings reports this week, the market will continue to be volatile. Even today, the market zigzagged, forming an ascending triangle, which later broke out. Again, I am seeing considerable strength in the materials and industrials sectors and they are leading whatever rally we do get.

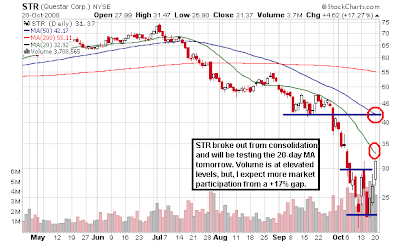

Most break outs, including the ones listed below are at a point where they are going to test 1) the 20-day MA, 2) September’s low, and then 3) the 50-day MA. The 20-day MA is not some magical indicator, but it’s what most stocks primarily follow during uptrends and is a secondary indicator for downtrends. These three present key resistance levels that need to be broken for stocks to climb out of their hole. It won’t be easy, but here are several names to focus on:

First Eagle Overseas Fund Q2 2025 Commentary

8 minutes ago