There is nothing new except that we are close to bursting out either up or down. I am guessing that some movement will occur ahead of Tuesday's 8:30AM GDP report. The consensus is -0.5% with a range of -0.8 to -0.5. The previous reading was -0.5%. I don't know how the consensus could remain the same as Q3, but whatever, everyone expects negative growth.

We also have Consumer Sentiment, Existing and New Home Sales (all three @ 10AM). The U. of Michigan sentiment index is expect to come in at 58.6 with a range of 53.6 to 60.2. The previous reading was 59.1. Existing home sales are expected to come in at 4.9M with a range of 4.750M to 5.04M. The previous reading was 4.98M. New home sales are expected to come in at 420K with a range of 360K to 490K. The previous reading was 433K.

Back to the charts. If we breakout then we formed an ascending triangle. If we breakdown, it's a bearish wedge. Looking at the 45-day intraday charts, a major move is most likely going to happen before Christmas given the lack breathing room at the end of the triangle/wedge.

The Dow appears to be the weakest. The Russell 2K is the strongest while the S&P and Naz remain 'neutral'. As for the moving averages, the Russell 2K is above, the Naz is sitting right on top, and the S&P and Dow are both below it. All four indices are bound by the 20-day and 30-day MA's in some way.

Looking at the VIX, we formed a 'hammer' candle, which is usually a reversal, but confirmation is needed. Upon layering it, the VIX is sitting right at the 100-day MA. The VIX tested the 100-day MA on Thursday and on Friday, the VIX managed to recoup most of its losses (notice the tails on both days). We "may" see an upside reversal on the VIX on Monday.

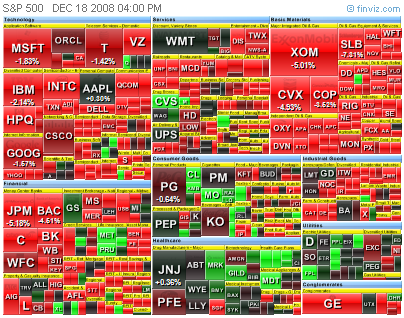

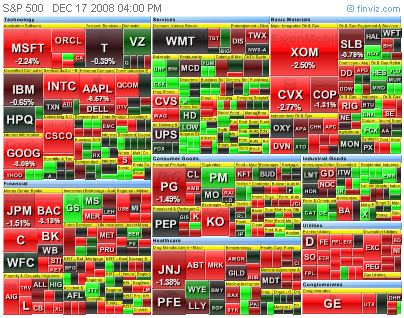

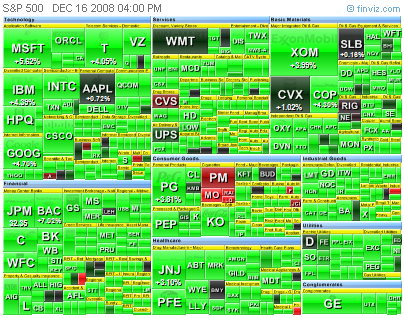

As for sectors, healthcare is the strongest. Utilities remains neutral. All the other sectors have to move up quickly because they are a hair away from breaking through their respective lower trendlines. The financial sector may be forming a head and shoulders. The industrial and technology sectors are forming lower highs (the tech sector technically broke down).

This entire month has been riddled with headache and a lack of reliable direction. I'm sure there was a lot of impulse trading going on. Once we break out or down, it will be easier to determine direction. Until then, traders have to either daytrade (very quickly) or sit tight and be patient (remain hedged), or remain in cash. Use the MA's and support/resistance as your guides.

For the 45-day intraday charts:

-the blue line is the 50-day MA (325p.)

-the green line is the 30-day MA (195p.)

-the pink line is the 20-day MA (130p.)

SPX 45-day

SPX 45-day DJIA 45-day

DJIA 45-day COMP 45-day

COMP 45-day Russell 2K 45-day

Russell 2K 45-day VIX 6-month

VIX 6-monthSPDR Select Sectors

Don't forget to try the Free Trend Analysis. It's FREE, so give it a shot!

Don't forget to try the Free Trend Analysis. It's FREE, so give it a shot!