I am aware that we have been down for 6 straight sessions, but know that the MSCI World index has been down 11 straight sessions, so heck, who knows, anything is possible. There are some things to note though on the individual indices.

First, the SPX closed 2 pts above the Nov low, which was 741.02. Volume indicates that we have not yet seen capitulation for all the dip buyers at the top. This sell-off is so slow and the buying is so weak that I'm questioning both sides of the market. Typically, the best thing to do is to have a large cash position available.

Second, the COMP is divergent with the SPX/DJIA and has yet to test it's own lows (Nov low: 1295.48). The volume is definitely not capitulatory and there is a lack of selling pressure. I see more downside room for the COMP, and by default, the SPX has more downside.

Third, the R2K, after the SPX, is likely to test it's own low (Nov low: 371.30) next. I also see more downside room for the small-caps.

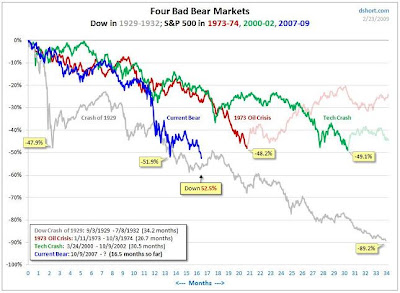

Fourth, the DJIA is broken and it's the first that's going to the abyss. Take a look at the comparison of the 4 large bears. This makes me wonder - we may actually be starting a new primary leg down on the DJIA. It is possible and I won't rule out it. The DJIA did break and close below the 2002 low (7197.49).

Where is the selling (the fearful and panicky type)? Long investors, when are you going to puke it all out? I remember the days when we would get huge gap downs, effectively marking capitulation, and a rush of buying would come in to mark a bottom. You also had cases where there would be huge massive intraday reversals that completely wiped out all losses on huge volume days. Those are the reversals you want to be buying, not the dips on a slow meltdown.

No comments:

Post a Comment