Today's move was expected. In yesterday's post, I mentioned that we could be forming a double bottom and if we did, 830 SPX would be the neckline. We broke out after we hit upper resistance several times, forming an ascending triangle. If you noticed between 12-2PM, we were churning while making a higher low since yesterday at 3PM. This pattern is one of the more highly reliable bullish patterns out there. Don't ask me if it'll last, because that all depends on the plethora of news that is supposed to come out this week. As for news...

What the hell is wrong with WFC? They were going to Vegas! I swear, these people just don't get it. Someone is going to flip out one day. You're going to see attacks on bankers. When the public hits a psychological tipping point, people start becoming irrational. This is how protests start, which then turn into riots, then sometimes, full-scale revolts. People are pissed off, but we haven't hit the tipping point. There are protests and riots going on everywhere in the world, so don't think that it won't happen over here.

I also read that "19 million homes stood vacant in 2008" on Bloomberg. That's the largest amount of housing supply that I've ever heard of. Most of you haven't seen many vacant properties, but let me just show you some in my photography collection. These are properties scattered throughout Baltimore and most of these can be bought for less than $5,000 apiece:

Depressing, right? This isn't just Baltimore's problem. Vacant properties are turning into a national plague for reasons I mentioned in yesterday's post. We just have to ride this out until supply and demand find equilibrium. Forcing banks to lend is a problem, not the solution. How is pushing more debt on people a smart decision? Massive amounts of debt is what started this mess in the first place. The gov't keeps trying to force things to happen. This will eventually lead to disaster.

Isn't this something? Also, don't forget that Chrysler is giving $20,000 plus a $25,000 voucher for a new car. Are you kidding me? Guess who's paying for all those cars? I am. You are. You seriously have to ask yourself, "where is all the bailout money going?". I guarantee you that these people will be coming back for another hand out. This is total horseshit.

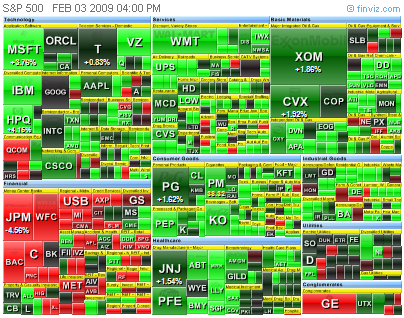

Take a look at the 40-day and the 4-month charts. The market is "boxed in". It is a term that I do not use frequently, but it basically means that the market is trapped within so many support and resistance levels that it has become more and more difficult to gauge pivot points for swing trading. If you have noticed, I've been in 80-90% cash overnight for weeks, and for good reason. Play this market minute-by-minute, day-by-day because "breaking news" is just around the corner.

Yesterday's top plays were short STI, PNC, RF, WFC, BAC, and LVS. The regional bank short play is and will continue to be lucrative for weeks to come. When a stock hits below the $2 mark, I cut all my profits + a min. of 50% of the original principal and rotate it into a higher priced stock. Rinse and repeat. This reduces risk for short squeezes or potential acquisitions.

We have tons of earnings out today:

Pre-market: ALU, ALVR, ARJ, BRS, CKSW, DVN, DBD, XJT, FOR, GR, KFT, NOV, NSTC, HI, RL, R, TWC/TWX, WIN.

Intra-day: AGN, BOFI, BCO, CFFN, CRNT, CSCO, CLX, CVLT, EFX, HSTX, HRC, LFUS, MPAC, PM, EGOV, SLE, SFLY, SLAB, SUN, TUP.

After-hours: AKAM, AEC, AIZ, ATML, AVB, BMC, CDNS, DTLK, CBL, DEL, DCP, ESS, HRS, MET, NEU, NXTY, OPNT, PRU, REG, SPTN, SSWS, VARI, V.

WARNING: Extremely Offensive.

WARNING: Extremely Offensive.Don't forget to try the Free Trend Analysis. It's FREE, so give it a shot!

6 comments:

I like your blog... In reference to WTF vexing act on there an usual act of using the money. They need to stop all this mess. 25 billion dollars is a lot money that shouldn`t be wasted.

http://www.youtube.com/watch?v=rAqPMJFaEdY&eurl=http://www.rumormillnews.com/cgi-bin/forum.cgi?read=140500

Consumers slowing, Visa reports after bell = Short the stock, amazing blog john

Consumers slowing, Visa reports after bell = Short the stock, amazing blog john

OOps,,my mistake on Visa, market seems to like it sorry for xitement. bye

Thanks!

Post a Comment