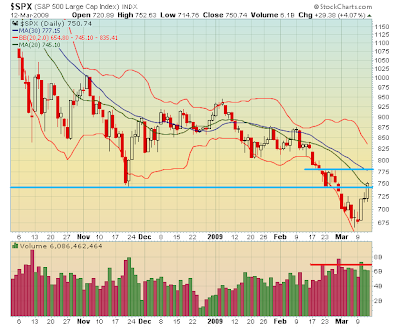

It gets tricky here as you can see in the 1 month/60-min chart. We are sitting right above the 20-day MA, only about 20 pts away from the 30-day MA, and there's a whole bunch of support and resistance all over the place. Keep in mind that it can get really choppy here. I think I'll sit this one out and take a road trip. In my opinion, we are due for a pullback and we are in a zone where it is very possible for that to happen. Also make note of the multi-month charts of the various indices approaching 'chop zones' and resistance areas. I take no chances here.

On a fundamental level, I find it hard to believe that C, JPM, WFC, and now BAC have all of a sudden become "profitable". BAC and C are stressing that they don't require anymore government capital. All of a sudden just like that? Businesses that lose money need to reach the breakeven stage before becoming profitable. All we can do is wait until they report to see if the CEOs told the truth, but I find it difficult to believe that the big boys are all making money now...just like that. Now THAT's a miracle!

2 comments:

John,

What is short/RIC,,,the mining stock?

Thanks,

P.S.,,March is the third month.

Enjoy your trip!

hey Bob,

RIC = rest in cash

Have a great weekend!

Post a Comment