The level of ridiculousness would depend on how the Gov't plans on pricing these bad assets. I'm actually curious if they'll create some new type of fancy accounting. Seriously, not even a homeless man would take these toxic assets, so we've come to the point where the Gov't is the only entity that is willing and able to buy the worst assets in the entire world on behalf of taxpayers . No one else can buy up enough shit to make a difference. Also, why do they still call them "assets"? If these "assets" brought down the financial world, then they are liabilities, regardless of what any accounting textbook says.

The big difference here is that the Treasury was buying preferred stock, conveniently deviating from the TARP's original plan. The Gov't will now be buying common stock. Taxpayers, keep in mind that this presents an even greater amount of risk to you, but who will keep the Gov't accountable? The fact that the Gov't will be buying up common stock in banks will send bank shares much higher. Expect significant short covering in the morning.

This plan obviously overshadows the FOMC meeting later today. No one seems to care too much because there's nothing really the Fed is expected to do. Are they going to drop rates to 0% or -0.25%? No. Are they going to raise it? They wouldn't dare + that's absurd and the market will frown upon it. Therefore, I expect no action. Besides, there mf-ers are too busy trying to resuscitate the economy with these creative programs, paid for by your kind donations to the Treasury.

Today's day was a perfect set up for the upside move, but I didn't have the guts to go long. It's fine, like I give a damn what you think. In fact, I've been in 100% cash overnight for almost 3 days, which is a very long time for me. Unless you're long, having an ample cash reserve gives you the opportunity to personally take advantage of the additional misuse of taxpayer's funds. The market completed a 5-day ascending triangle, which will break to the upside (as of 1:09AM EST). The financials should be your focus for today, so keep an eye on BAC, C, JPM, WFC, GS, MS, etc.

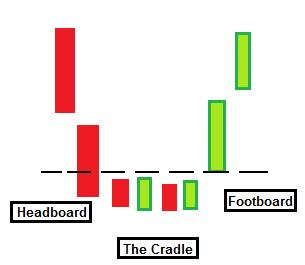

I have a feeling that the financials will spike higher on consecutive or near-consecutive multiple days, in a very short time. I talked about the flag formation in my post yesterday and it looks like today will present the upside breakout. The after-hours action (as of 8:00PM EST) dictated that most financials will open slightly above their respective flags' only resistance area. A long spike at the close will also create a 'Cradle' pattern, one of the highest reliable and profitable candle combo patterns during a downtrend. They are one of the most dramatic displays of immediate changes in sentiment. This only matters if the banks CLOSE UP and above their flags' resistance.

Did you hear what I said? There needs to be a strong close. This means that if a "WTF" pattern popped it's head up at 3:55PM and crashed the market, then this negates everything. For the open, I'd prob add an initial starter position in the banks, then either 1) add on sustained momentum, or if the gap suddenly fills, 2) add on a breakout of the gap's opening price. Both are determined in the first 15-30 mins of trading. Trade accordingly.

Did you hear what I said? There needs to be a strong close. This means that if a "WTF" pattern popped it's head up at 3:55PM and crashed the market, then this negates everything. For the open, I'd prob add an initial starter position in the banks, then either 1) add on sustained momentum, or if the gap suddenly fills, 2) add on a breakout of the gap's opening price. Both are determined in the first 15-30 mins of trading. Trade accordingly.One more detail: Don't forget that the House will vote on the $816 billion stimulus bill TODAY. There's never been a time where I've seen the words "billion" and "trillion" appear so freakin' much. Congress throws these words around as if it's chump change. Am I right? You hear "billions" more than "millions" as if spending the latter went completely out of style.

Cramer is starting to use technicals. God help us.

1 comment:

How Mr Benjamin Lee service grant me a loan!!!

Hello everyone, I'm Lea Paige Matteo from Zurich Switzerland and want to use this medium to express gratitude to Mr Benjamin service for fulfilling his promise by granting me a loan, I was stuck in a financial situation and needed to refinance and pay my bills as well as start up a Business. I tried seeking for loans from various loan firms both private and corporate organisations but never succeeded and most banks declined my credit request. But as God would have it, I was introduced by a friend named Lisa Rice to this funding service and undergone the due process of obtaining a loan from the company, to my greatest surprise within 5 working days just like my friend Lisa, I was also granted a loan of $216,000.00 So my advise to everyone who desires a loan, "if you must contact any firm with reference to securing a loan online with low interest rate of 1.9% rate and better repayment plans/schedule, please contact this funding service. Besides, he doesn't know that am doing this but due to the joy in me, I'm so happy and wish to let people know more about this great company whom truly give out loans, it is my prayer that GOD should bless them more as they put smiles on peoples faces. You can contact them via email on { 247officedept@gmail.com} or Text through Whatsapp +1-989 394 3740.

Post a Comment