So, what's been doing fairly well long-term? The utilities, because they haven't been going anywhere. Other sectors such as the materials, industrials, consumer disc. & staples, among others, are threatening to break down. Yesterday, I mentioned that the market cannot rally without the financials. This remains true. The overall health of the market depends on this sector. In addition, we started making more new lows than highs. The $NYHL and $NAHL are negative once again.

As for index breakdowns, the DJIA is leading the decline, followed by the SPY, R2K, and the COMP. The important matter is how the market is churning at the 50-day MA. This has been going on for over a month now without much progress at this key intermediate support level. Usually, you want to see the market use the 50-day MA as a "springboard" to propel itself higher. It is presently not the case.

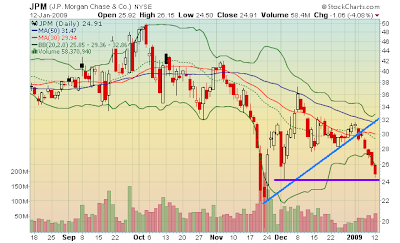

We still have one major support level at 855 to clear before we start a multi-day decline. The focus continues to be on the financials, especially C (and JPM on the 15th). The trend is intact until it isn't. The financials have broken their trend and it appears that the market will follow for now.

SPX Initial Support: 860

Resistance: 20-day @ 892

Resistance: 30-day @ 885

Resistance: 50-day @ 882

Don't forget to try the Free Trend Analysis. It's FREE, so give it a shot!

No comments:

Post a Comment