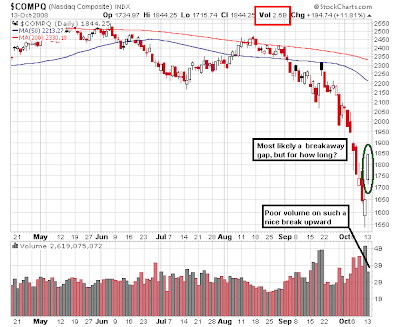

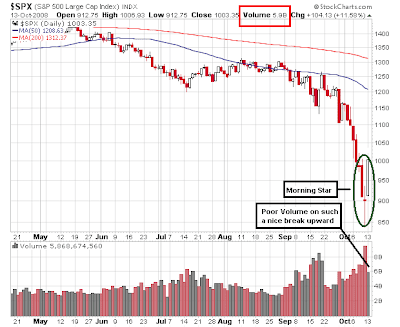

We were so oversold that we had the best day in 75 years. In order for me to be convinced, I need to see two things: 1) stronger volume and 2) the rally must cancel out all loss since late-September.

Volume was extremely light and I do understand that Columbus did reach the New World and all today, but the Volume of the first day, basically sets the tone for the next up days. Expect lighter and lighter volume as we reach a reversal point. If this rally formed slow and stead and not in full force, it would be more sustainable, however we are trying to power spike our way out of market hell.

This doesn't work because market participants have already lost trillions in this bear market and investors are paralyzed from making decisions after getting killed. Who trusts these markets anymore? Not your average retail investor. How about institutions? They should be the first ones buying alongside the short-covering.

Tomorrow's volume will confirm whether I'll be going short in a few days because a rally cannot be sustained on such weakness. Yes, it was a great move up, but volume must confirm price action. As for a dead cat bounce, this is like a cat that died 9x and got a free ticket to kitty heaven...except it'll be round trip.

Don't forget to try out the Free Trend Analysis. It's FREE, so give it a shot!

2 comments:

so if tomorrow's volume is lighter than today then we should cash out and get ready to short the market John?

PS: I can't wait to read the rest of your TA 101 series.

Tradermarketinfo-

Hi John,

With all the gov bail out in banks, do you think we are at bottom now after 900 points rally yesterday. Should I long... Thanks

Post a Comment